Some jurisdictions have raised concerns about the Live Local Act, citing anticipated ad valorem (property tax) revenue losses. This article aims to refute this criticism by examining the economic dynamics of redevelopment and illustrating how the Act may expand local tax bases and promote economic growth.

By Harrison Denman, Research Analyst @ The Euclid Group

Understanding Affordable Housing Property Exemption

One of Live Local’s incentive programs is a 75% exemption from ad valorem taxes for qualifying developments. The exemption applies only to the affordable units in a project and a proportionate share of the common area/amenity space and land value associated with the affordable component, as determined by a certified local property appraiser.

Qualifying residential projects must meet the following requirements:

i) The affordable units must be within a development that was completed or substantially improved within five years of the first application for the tax exemption.

ii) The development must contain 71 or more affordable units for families earning 81% to 120% of the Area Median Income (AMI).

iii) The rents for the affordable units must be less than either the FHFC 120% AMI rent limit or 90% of the fair market rate, as determined by a local rent study.

Addressing Concerns

One of the Act’s critiques is that Live Local projects increase demand for local utilities and infrastructure, which may not be capable of handling increased levels of service. Many jurisdictions believe this issue will be compounded by property tax exemptions, which are used to improve facilities and infrastructure.

In response to these concerns, the legislature passed an opt out provision allowing certain county and municipal taxing authorities to opt out of providing the 75% ad valorem exemption. The jurisdictions must be in a Metropolitan Statistical Area (MSA) with a surplus of affordable units for households earning up to 120% AMI identified in the annual Shimberg Center Housing Report. The opt out must be renewed yearly pursuant to the Shimberg study surplus/deficit of units.

The 2023 report found that 16 of the 26 Florida MSAs (50 of the 67 counties) have a surplus of units and may vote to opt out. Several jurisdictions have already done so. Pasco County was the first to opt out for the 2026 tax year, citing concerns of significant tax revenue losses, estimated to be in the tens of millions of dollars, and the belief that Live Local will not substantially increase the availability of low-cost housing.

Though not without merit, the concern may be shortsighted. Analysis of local property appraiser data suggests Live Local development would yield a significant increase in tax revenues, allowing local government to provide the services necessary to accommodate growth.

Pasco Case Study: Economic Impacts and Ad Valorem Burden

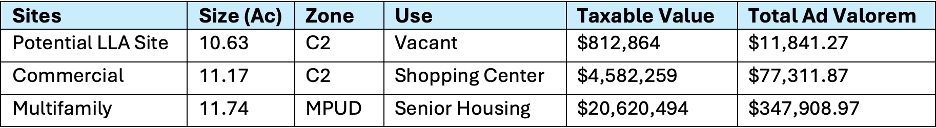

Comparing data from three Pasco properties illustrates the Act’s potential. A vacant lot contributing $11,000 in ad valorem taxes would generate much higher tax revenues if developed for multi-family or mixed use than for commercial use only—even with ad valorem exemptions.

For example, if we adjust the total ad valorem taxes of the “Multifamily” property to include tax exemptions for eligible units and optimistically consider a 75% exemption applied to 40% of the property, the projected ad valorem tax approaches $240,000. This amount is more than triple the revenue the county obtains from a similarly sized property designated solely for “Commercial” use. Also worth noting is that by opting out of the exemption, a local jurisdiction increases the likelihood that more property remains vacant and underutilized or developed in a comparably inefficient manner. Live Local projects can increase tax income and stimulate local economies through enhanced commercial activity.

Conclusion

The Act encourages the conversion of commercial, industrial, and mixed-use properties into multi-family developments. One way it does this is through tax exemptions for affordable units and projects meeting the necessary requirements. Other incentives include expedited approval and land use preemptions that promote the redevelopment of underutilized sites (such as old strip malls) into vibrant mixed-use communities.

The result? Properties with outdated tax assessments and limited development opportunities can now be built more densely, driving up property assessment values and boosting local ad valorem revenue while fostering economic growth and countering urban sprawl.

As we consider the future of development in Pasco and around Florida, it is crucial to balance immediate fiscal impacts with long-term growth and sustainability. The Live Local Act offers a framework that, if implemented thoughtfully, could transform underused areas into thriving communities. As more developers propose projects and more local governments gauge their responses to Live Local, it would be wise to consider why NIMBY approaches may be more harmful than helpful to economies and community growth.

Harrison Denman is a lifelong Miami resident and analyst for The Euclid Group, a full-service land-use development and real estate consulting firm based in South Florida. Harrison’s practice focuses on researching and summarizing complex land development regulations to facilitate land optimization and related development decisions. Additionally, he leads the Euclid Group research initiatives on numerous legislative matters, including the Live Local Act.